Beckett Grading’s Struggles and Industry Impact

Beckett Grading Services, a prominent name in sports card grading, is experiencing a significant downturn amidst a booming industry and an ownership scandal. The month of November saw a staggering 32% drop in graded cards compared to October, with a substantial 43% decline year-over-year. These troubling numbers paint a grim picture for Beckett, which was only down 13% year-over-year as of August.

The situation has been worsened by the legal issues surrounding Greg Lindberg, the owner of Beckett’s parent company. Lindberg’s involvement in a $2 billion insurance fraud scheme has uncovered financial instability within the company. Recent court filings revealed a $100 million loan secured against Beckett Grading Services, yet the company purportedly received a mere $500,000 from the loan. This mismanagement has raised doubts about Beckett’s ability to recover, with the looming threat of liquidation as Lindberg’s assets face scrutiny.

The scandal has shaken collector confidence, exacerbating Beckett’s struggles to maintain its position in the competitive grading industry. While Beckett’s former dominance in card grading once seemed unshakable, it is now facing challenges on multiple fronts.

Amidst a thriving market, Beckett has failed to capitalize on the industry growth. The company now finds itself falling behind competitors, with PSA, SGC, and CGC Cards experiencing significant increases in grading volumes. CGC, known for its focus on TCG and non-sport cards, surpassed Beckett in sports card grading in November despite sports cards making up only 13.1% of its total output. In contrast, sports cards accounted for 60% of Beckett’s total volume, highlighting its struggles even in its primary market.

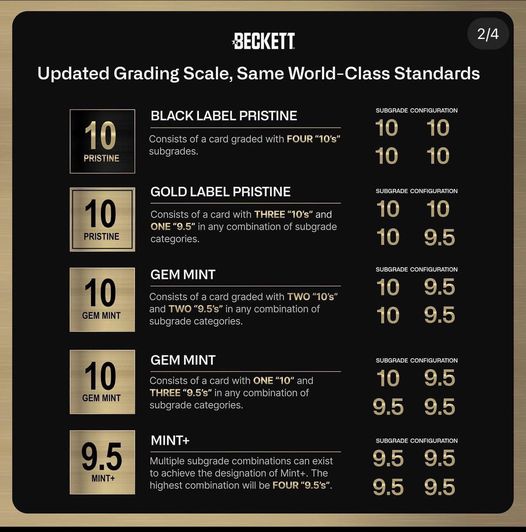

While Beckett continues to excel in niche markets with its Black Label 10s and Pristine 10s, these specialties cannot offset losses in high-volume grading. Competitors have intensified their promotional efforts, diverting attention away from Beckett’s offerings. Despite recent attempts such as holiday specials, Beckett’s comparatively higher pricing has made it less appealing in the current market landscape.

Moreover, Beckett’s diminishing role in grading iconic cards, such as the 1952 Mickey Mantle and the 1989 Upper Deck Ken Griffey Jr., raises concerns about its relevance in areas where it once dominated. GemRate’s Iconic Tracker reflects a decline in Beckett’s grading activity for these marquee items, signaling a loss of momentum in previously strong segments.

Despite these challenges, Beckett retains a competitive edge in certain niches. The company continues to witness strong demand for high-end basketball cards and maintains relevance in the TCG market through its Black Label focus. Success in grading limited-release Topps Now cards also adds a positive note, although momentum in this area saw a decline in November.

As Beckett Grading Services navigates through mounting challenges, its future remains uncertain. The company’s reputation for premium grades holds value in specialized markets, yet the overall decline in grading volume suggests deeper systemic issues. Can Beckett undergo restructuring to reclaim its position, or will its downward trajectory persist? The industry and collectors alike await eagerly to witness the company’s response to adversity and its efforts to adapt in an ever-evolving marketplace.